trust capital gains tax rate 2020

Capital gains and qualified dividends. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits.

Trust Tax Rates And Exemptions For 2022 Smartasset

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

. Trust tax rates are very high as you can see here. Add this to your taxable income. This 5 Fund Portfolio Pays A Monthly 8 9 Dividend In 2021 Dividend Real Estate Investment Trust Investing.

For tax year 2020 the 20 rate applies to amounts above 13150. First deduct the Capital Gains tax-free allowance from your taxable gain. Ad Gain Access To Investment Cash Management Strategies At Bank of America Private Bank.

The following Capital Gains Tax rates apply. Ad Gain Access To Investment Cash Management Strategies At Bank of America Private Bank. The trust has the following 2020 sources of income and deduction.

18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you need to work. Your 2021 Tax Bracket To See Whats Been Adjusted. It also deals with.

Ad If you have a 500000 portfolio be prepared to have enough income for your retirement. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. The 15 rate applies to.

By comparison a single investor pays 0 on capital gains if their taxable. Ad Compare Your 2022 Tax Bracket vs. The 0 rate applies up to 2650.

Download The 15-Minute Retirement Plan by Fisher Investments. 4 rows The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets. For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. HS294 Trusts and Capital Gains Tax 2020 Updated 6 April 2022. Where the capital gain is attributed to the trust the effective rate of tax on a capital gain is 36.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Trust capital gains tax rate 2021 Sunday February 27 2022 Edit. This helpsheet explains how United Kingdom UK resident trusts are treated for Capital Gains Tax CGT.

Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. Capital gains taxes on assets held for a year or less correspond to. Qualified dividends are taxed as capital gain rather than as ordinary income.

Ad Find Deals on turbo tax online in Software on Amazon. The 0 and 15 rates continue to apply to certain threshold. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

Where a trust is a special trust only 40 of the capital gain is included in the. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a. However long term capital gain generated by a trust still.

Discover Helpful Information And Resources On Taxes From AARP. For tax year 2020 the 20 maximum capital gain rate applies to estates and trusts with income above 13150. 4 rows In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000.

For example if a trust has taxable income of 13000 in 2019 and then subsequently makes a distribution of 13000 to a beneficiary within the 65-day window in. For tax year 2021 the 20 maximum capital gain rate applies to estates and trusts with income above 13250. The trustee of an irrevocable trust has discretion to distribute income including capital gains.

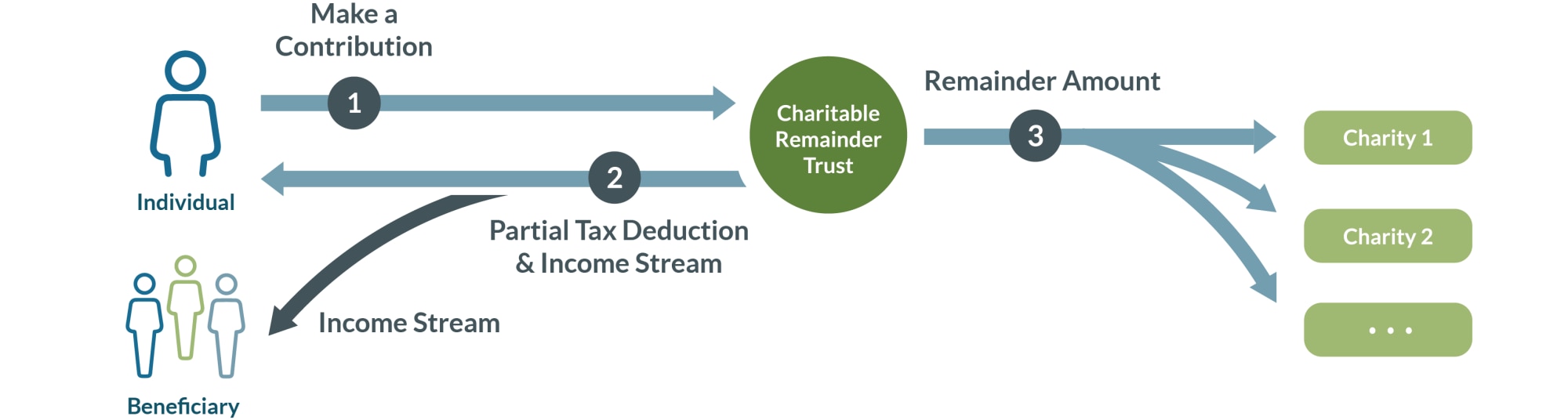

Charitable Remainder Trusts Fidelity Charitable

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Tax Advantages For Donor Advised Funds Nptrust

Trust Tax Rates And Exemptions For 2022 Smartasset

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

Pin By The Taxtalk On Income Tax Investing Capital Gain Capital Assets

Capital Gains Tax What Is It When Do You Pay It

Using A 1031 Exchange To Turn A Rental Property Into A Primary Residence Property Rental Property Property Investment Uk

Distributable Net Income Tax Rules For Bypass Trusts

What Are The Social Security Trust Funds And How Are They Financed Tax Policy Center

Test Bank And Solutions For Canadian Income Taxation 2020 2021 23rd Canadian Edition 23ce By Buckwold Studocu Test Bank Lectures Notes Corporate Tax Rate

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Trust Tax Rates And Exemptions For 2022 Smartasset

Tax Rebate Digital Tax Filing Taxes Tax Services

Figure Pay Qualities With Our Free Pay Charge Instrument That Will Pull In Salaried Stars Of Government And Private D Income Tax Return Income Tax Filing Taxes

Moneyweek 27 March 2020 Financial Magazine Money Safe Star Company